We won the Hedera India Hackathon 2024, jointly hosted by The Hashgraph Association and Information Data Systems (IDS)! Click here to learn more.

We won the Hedera India Hackathon 2024, jointly hosted by The Hashgraph Association and Information Data Systems (IDS)! Click here to learn more.

Back

Identity verification is a fundamental part of our daily interactions, whether opening a new bank account, checking into a hotel, or making an online purchase, identity verification is essential. Indeed, traditional methods of verification are often slow, repetitive, and fraught with security risks. Enter reusable IDs – solutions which are designed to take on such challenges.

The Problem with Traditional Identity Verification

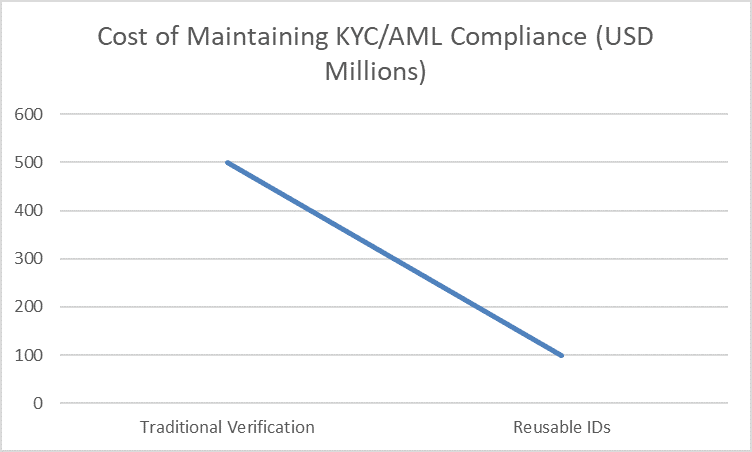

Costly Verification Processes:

|

|

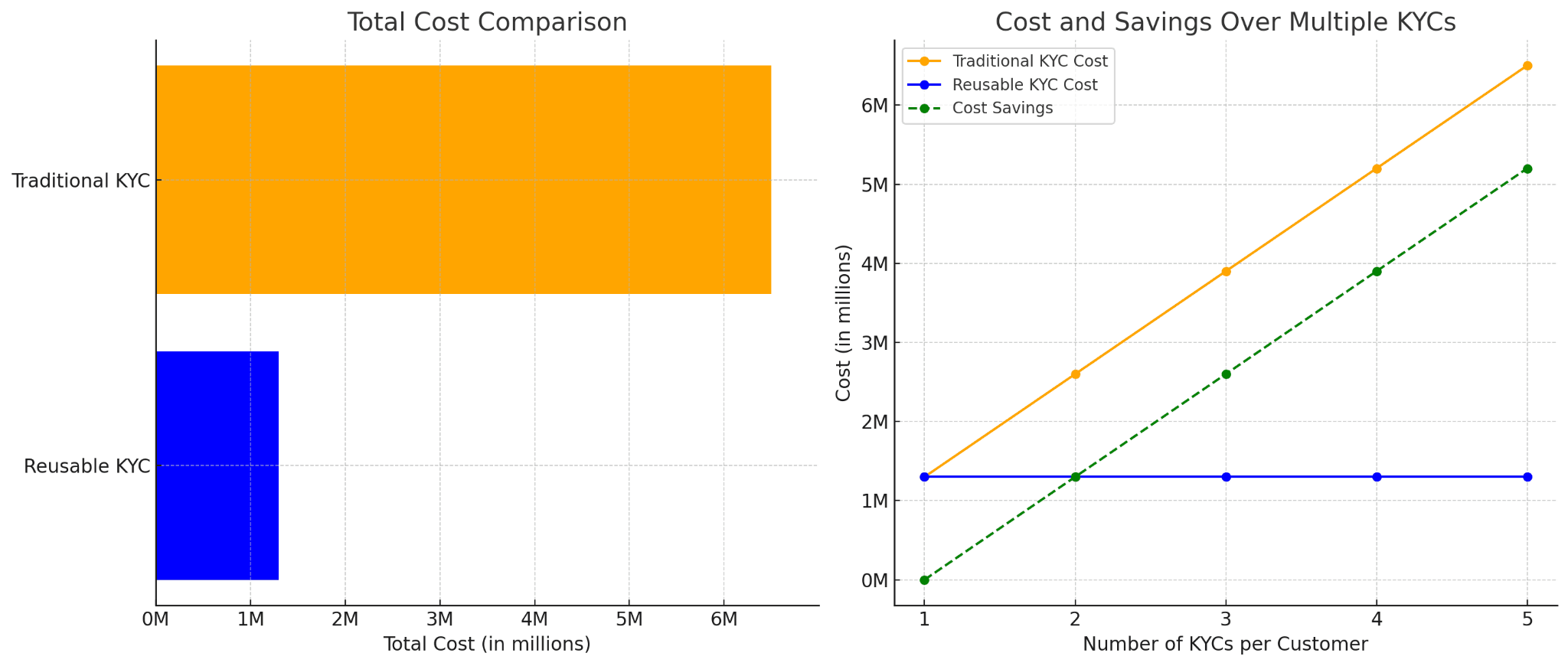

This translates to a potential savings of $5.2 million, illustrating the substantial financial benefits of adopting reusable KYC solutions on a large scale.

|

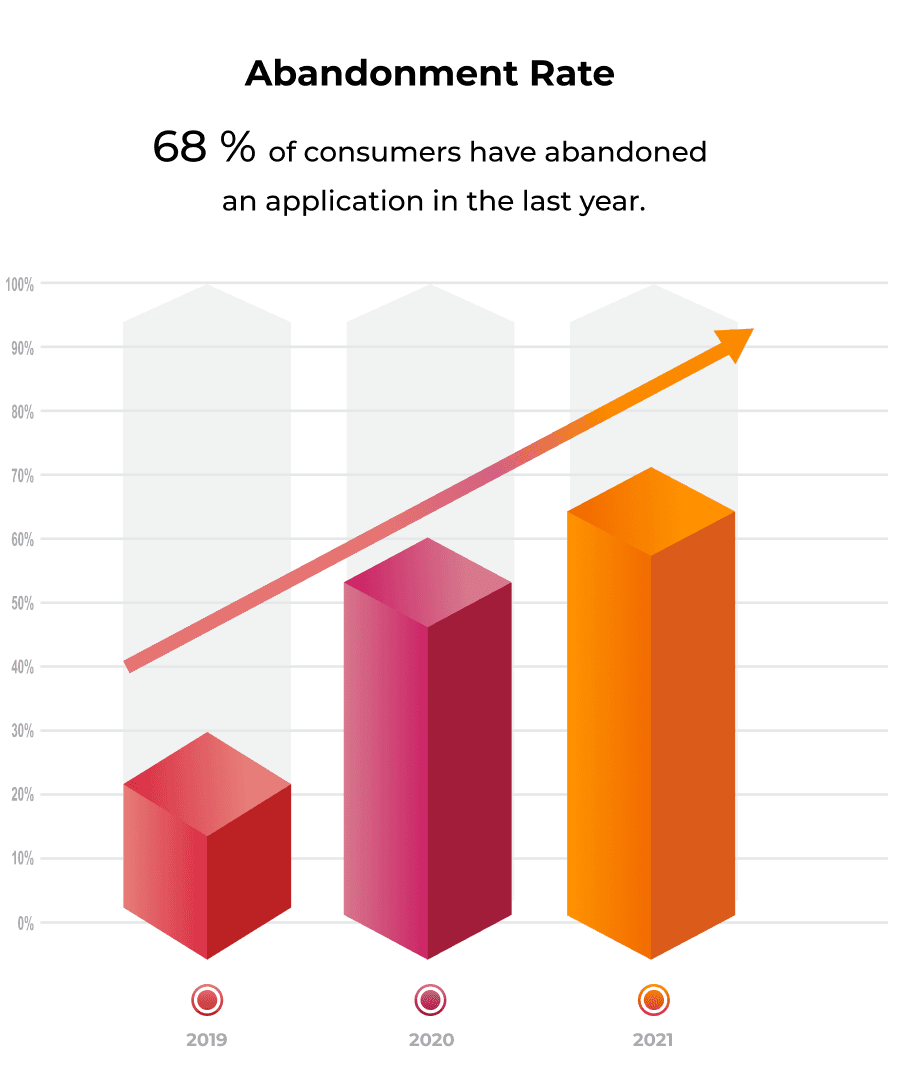

| Complexities in Online Verification: While in-person identity verification is straightforward, verifying identities online presents significant challenges. According to a Moneycontrol report in 2019, the global commercial banking sector suffered a significant loss of USD 3.3 trillion due to abandoned onboarding applications. |  |

Despite technological advancements, there is still heavy reliance on physical IDs, like birth certificates and driver's licenses, in the digital world.

Introducing Reusable IDs: A Modern Solution

What Are Reusable IDs?

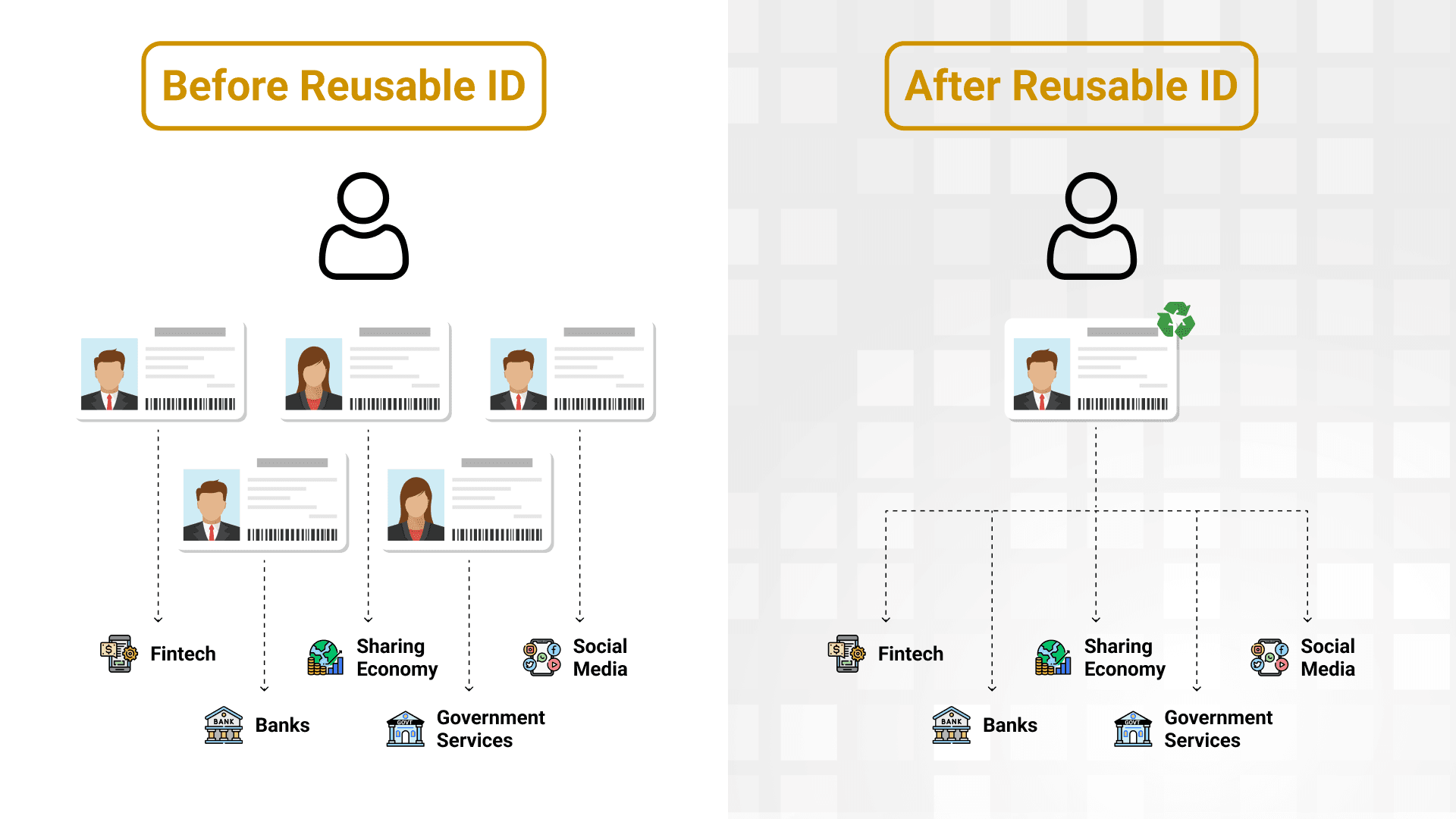

Reusable IDs are secure, portable and interoperable digital representations of a person’s verified identity. Instead of undergoing repeated verification processes for each service, users can verify their identity once and business entities can reuse this verified information across multiple departments. This innovation significantly enhances security, efficiency, and user experience.

How Do Reusable IDs Work?

Reusable IDs combined with advanced technologies like Decentralized Identifiers (DIDs), Verifiable Credentials (VCs), and digital wallets ensure secure and privacy-preserving identity verification. After a user proves their real identity through an ID verification service by submitting legal ID and taking a selfie, their verified identity is stored securely in a digital credential within a digital wallet app.

This clearly departs from traditional practices where every institution verifies new customers individually. This allows securely sharing of verified identity data across institutions with user consent and reduces redundancy to enhance operational efficiency and security.

The Advantages of Reusable IDs

The advanced encryption and authentication technologies used in reusable IDs reduce risks of identity theft and other fraudulent activities that could arise from having multiple verification channels. It ensures privacy attributes through zero-knowledge proofs, selective disclosure, and other equivalents that allow the user to only disclose very relevant information while maintaining privacy.

By eliminating redundant verification steps, reusable IDs reduce administrative burdens and operational costs. Businesses can reallocate resources more effectively, improving efficiency and customer service. Standardized verification procedures also simplify compliance, ensuring consistent and reliable identity verification across different institutions.

Reusable IDs offer a better user experience by making transactions much easier and simplifying onboarding processes. The ability to use just one verified identity across services promotes trust and loyalty with customers. Additionally, reusable IDs empower users to control their personal data, deciding who has access to their information and when.

Implementing reusable IDs contributes to environmental sustainability by reducing the need for paper-based verification processes. By transitioning to digital identities, organizations can significantly decrease their paper consumption, which supports Sustainable Development Goal 12.5. This not only minimizes the environmental impact but also aligns with global efforts to promote sustainable practices and reduce waste.

Real-World Applications and Benefits

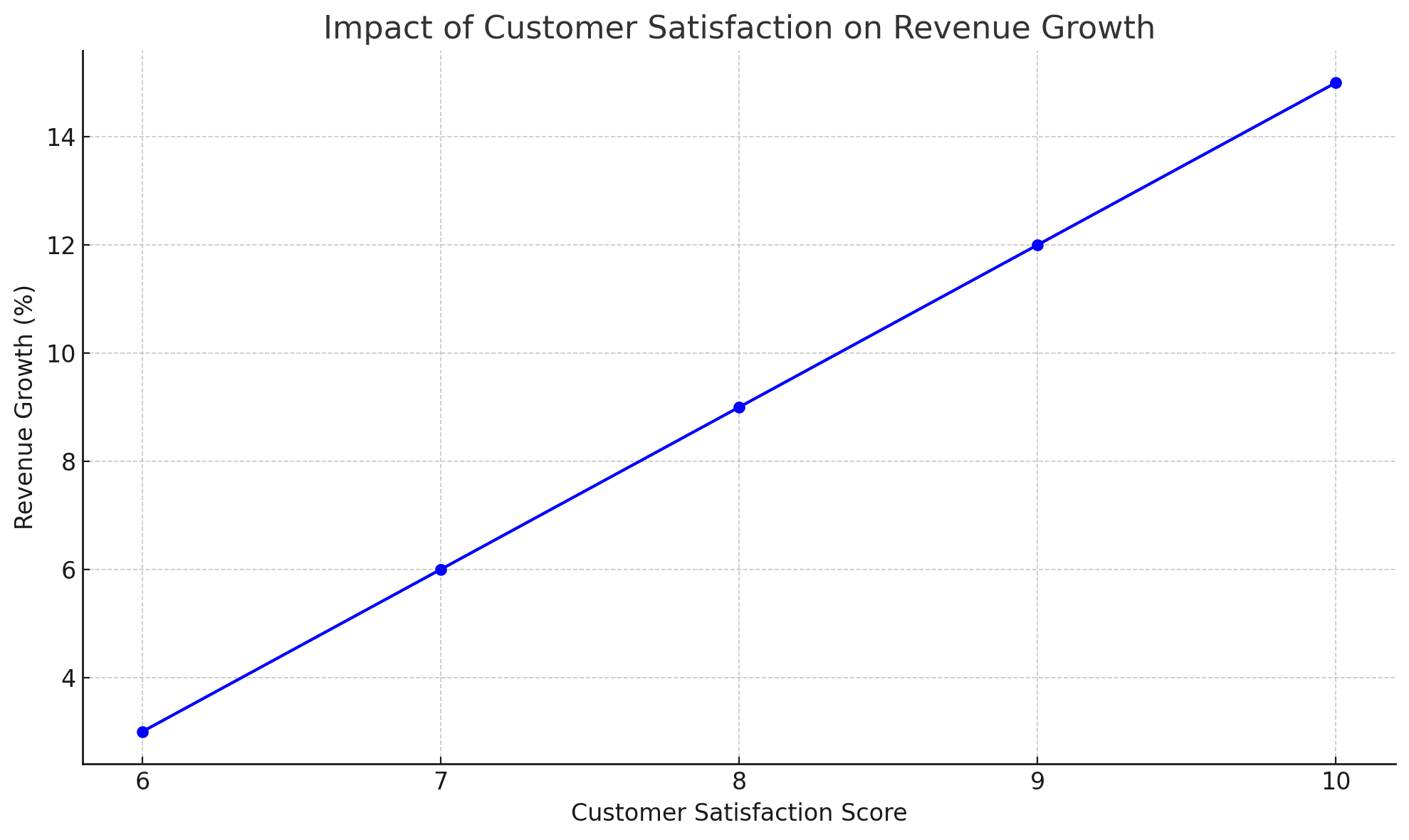

Reusable IDs ease customer onboarding, saving time and resources spent on repeated identity checks. This enhances operational efficiency due to a reduction in time and resources spent on manual verification, improving customer satisfaction and experience. This also reduces the costs incurred from several verification events.

Reusable IDs enable quicker access to services by verifying patient identities swiftly and securely. This approach enhances patient care and simplifies compliance with privacy regulations that protect crucial medical information.

With reusable identities, users can confirm their age for restricted online services, such as buying alcohol or viewing adult content, without revealing other personal details. This approach protects user privacy while meeting legal requirements, offering a secure and efficient solution for age verification.

Advantages of Reusable Identities for Businesses

|

|

Conclusion: Embracing the Future of Identity Verification

Reusable IDs represent a transformative shift in identity verification, offering unparalleled security, efficiency, and user convenience. By addressing the pain points of traditional methods, reusable IDs empower businesses to enhance operational standards, comply with regulations, and build stronger customer relationships.

CREDEBL is designed to transform your identity verification process with its innovative reusable ID solution. Leveraging advanced technologies, CREDEBL provides secure, efficient, and user-friendly verification, helping businesses enhance their operations and build stronger connections with customers. As an open-source platform and a recognized Digital Public Good (DPG), CREDEBL offers transparency, accessibility, and widespread adoption, making it an ideal choice for organizations seeking reliable and advanced identity solutions.

With CREDEBL, sensitive information is protected with features like Zero-Knowledge Proofs and selective disclosure, ensuring that users control their personal data and share only what is necessary.

Ready to revolutionize your identity verification process? Contact us today to discover how CREDEBL can transform your operations and elevate your customer experience.

© 2015 - 2025 AYANWORKS Technology Solutions Private Limited